Why Ta’ Qali would be an ideal site to test driverless cars

The island can replicate its regulatory success in gaming and maritime by moving early on autonomous mobility, positioning itself as a European testing ground, says Matthew Bezzina.

In cities across the US and Asia, so-called autonomous vehicles (AVs) are already operating at commercial scale.

Europe, by contrast, remains fragmented, slowed by cautious approval processes and unresolved questions around safety, liability, and oversight.

A stand-out is London, which earlier this year signalled its intent to host competing US and Chinese robotaxi operators – a sign that the British capital is willing to define how this new technology operates within its borders.

Malta should take note.

We have seen time and again that when proactive regulators embrace emerging technology, the country is rewarded with investment from businesses at the bleeding edge of innovation.

In gaming, aviation, and maritime services, we were among the first to offer clear licensing, enforceable standards, and predictable oversight. This helped turn complex and even high-risk sectors into durable pillars of our economy.

I believe autonomous mobility could be next, but only if we move decisively to shape the narrative rather than wait for others.

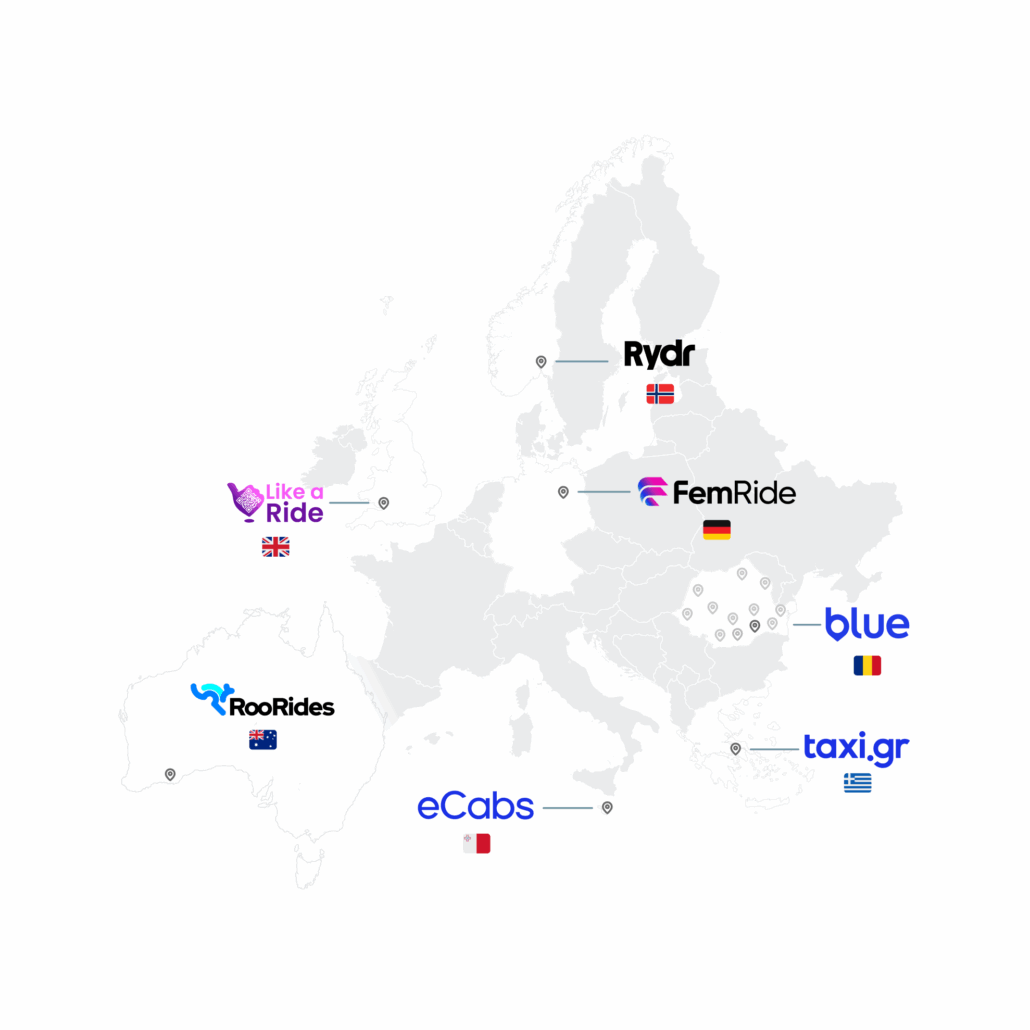

At eCabs Technologies, we are actively working on integrating new infrastructure to support driverless cars across the multiple countries and cities where we operate.

This is not a distant, pie-in-the-sky, scenario.

We know that it is only a matter of time before one, if not more, of the operators in the 12 cities and territories we currently support will deploy driverless cars.

Last week, I attended the Meet-the-Cab conference in Vienna, Europe’s largest taxi industry gathering, where the future of urban mobility in an autonomous vehicle landscape dominated most of the agenda.

The presence of senior representatives from leaders in the driverless industry such as MOIA (Volkswagen Group), Tensor, Pony.ai, and German innovators INYO made it clear that AV discussions have now moved beyond speculation and well into strategic planning.

What emerged in Vienna was a pragmatic consensus: driverless vehicles will not replace entire taxi fleets overnight.

Instead, the preferred model is hybrid fleet integration, where operators gradually introduce autonomous vehicles alongside human-driven cars

For example, one European operator I spoke to plans on running 20 autonomous vehicles within a fleet of 200, rather than attempting a wholesale transformation from day one.

This approach will reduce risk, allow for iterative learning, and ensure operators can maintain service continuity while regulators and insurers have the breathing space to catch up.

It also means that driver jobs will not be at risk. I believe Malta should seize this emerging opportunity. The first step is to establish a controlled regulatory sandbox where autonomous vehicles can be tested, monitored, and governed.

Ta’ Qali offers an ideal site and would not be an academic exercise, but a commercial and legislative petri dish where driverless technology can be deployed and studied under real-world conditions.

It would allow the government to concentrate testing activity into a defined area, rather than dispersing pilots across our already stressed public roads.

Within this sandbox, regulators could observe vehicle behaviour and develop approval processes before authorising wider deployment.

Public safety cases could be stress tested, and insurance and liability frameworks drafted and fine-tuned. Critically, and for the sandbox to matter, it must reflect how autonomous vehicles will actually be used in the real world.

Autonomous vehicles will not operate as standalone consumer products. Some private individuals will invest in this technology, sure. But, the vast majority of these driverless cars will run as fleets, dispatched, priced, monitored, and governed through mobility platforms like those powered by eCabs Technologies.

That is how this technology is spreading globally.

Even in major capitals, autonomous trials are proceeding within tightly defined regulatory frameworks, requiring coordination between city authorities, transport agencies, and licensing bodies.

This is where Malta already has an advantage. Today, eCabs Technologies operates one of the largest fully compliant mobility fleets on the island, and our technology powers ride hailing operations across multiple regulated markets in Europe and beyond.

That makes us a natural intermediary between driverless vehicle manufacturers and national regulators, offering a neutral operating layer where technology can be tested.

As I said: we are not waiting for Malta and have already begun developing the infrastructure to support this technology so that when Frankfurt, Bratislava, or Australia decide to introduce AVs, we will be ready.

During last month’s Vienna conference, leaders in the AV global industry that I met with all agreed that deploying autonomous vehicles within a Maltese regulatory sandbox would shift the exercise from a technical trial to a commercial reality check.

The economic opportunity also extends beyond mobility.

If Malta grabs this bull by the horns, then it would also create demand for insurance, legal, and liability innovation, as well as new safety certification, regulatory technology, and compliance services.

These are exportable capabilities that Malta could develop.

It is clear that the island cannot compete on hardware, but on governance and regulatory expertise? This is a space where small jurisdictions can move faster than those constrained bureaucratic inertia.

Malta has carved out footholds of relevance before by making complex systems governable. If we wait, others will decide the rules. If we move now, Malta can help write them.