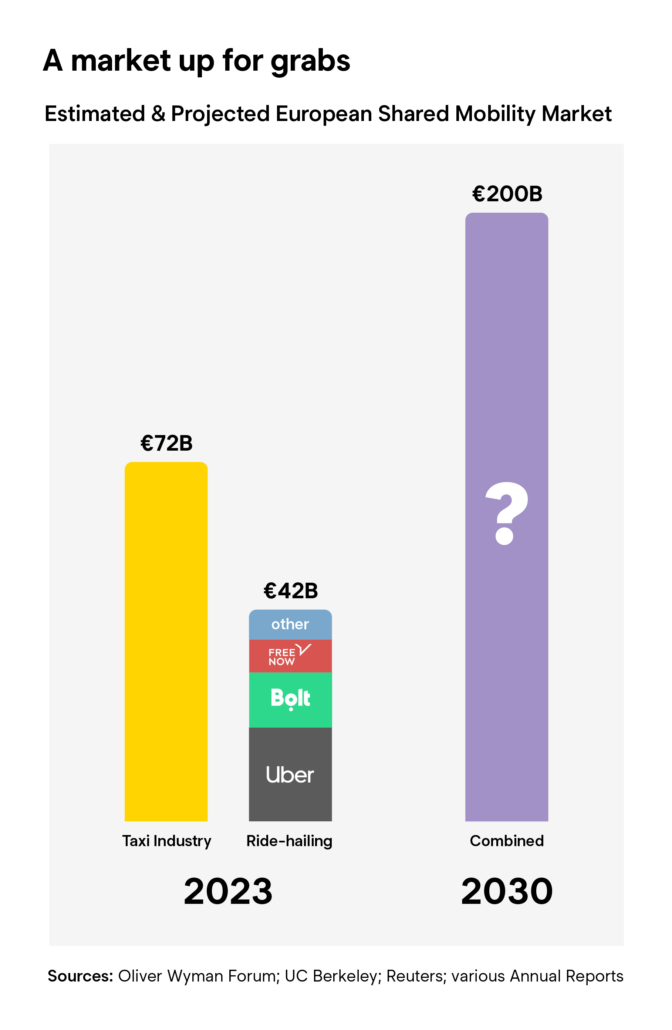

Europe’s shared mobility market is growing 20% annually, to reach €200 billion by 2030 – Uber and co. want it all

How will legacy operators fight back?

If you operate a taxi business or association today, this is what the likes of Uber and other ride-hailing giants don’t want you to know: the combined taxi and ride-hailing sectors are growing 20% every single year. And, by 2030, Europe’s shared mobility market is projected to generate €200 billion in annual revenues.

But, while legacy operators are dreaming of market share and margins of yesteryear, ride-hailing giants are growing faster than you think.

These Trojan Horses are silently sneaking into cities across Europe – luring drivers and taxi operators with promises of ‘low commissions’ and ‘platform partnerships’.

But what they are really doing is robbing legacy operators of everything they have worked so hard to build.

Traditionally, the shared mobility market has been anchored by taxi businesses and associations-regulated, for-hire chauffeured vehicles available through curbside hail, pre-booking, or dispatch. These businesses were and remain the backbone of this sector. If you run one of these operations today, do not make the mistake of believing you are the underdog. Because this is not a David vs Goliath story – not quite.

Sure, many of these large ride-hailing platforms can draw on billions in investor funding, but legacy operators still make up about half of Europe’s shared mobility sector. And, more importantly, you have something that these new rivals don’t. Legacy operators have built fleets of loyal and trustworthy drivers – something platforms need to spend big on to try and win over.

You also have deeply ingrained brand recognition, in some cases built over decades if not even generations. And most of you operate in regulatory environments that were designed around you and your needs.

The Ubers of this world on the other hand? They will do whatever it takes to steal your driver supply. They will weaponise their sleek apps to dazzle riders too. They will deploy sweeping, glitzy marketing and social media campaigns. They will even engage in product placement with streaming services like Netflix, targeting the GenZ and GenAlpha riders and drivers of tomorrow.

All the while, they will bully regulators into redesigning policy frameworks to work for them, and – if possible – against you.

These platforms don’t want a slice – they’re after the whole pie.

Embracing the future

Every year, ride-hailing’s share of the European mobility market grows. And, although traditional operators still have an edge, their life expectancy will hinge on their willingness to adapt to new realities. The past is over. The mobility market of the early 2010s cannot be recreated.

Today, more than ever before, it has become essential for taxi operators to embrace emerging technology. Younger generations expect seamless, user-friendly, app-based experiences. They expect this and just won’t settle for less.

Meanwhile, as car ownership declines and urbanisation continues to rise, the demand for efficient shared mobility solutions will only continue to grow.

Countries are also looking inward for innovation, particularly as the trend of hyper-globalisation has hit the brakes. This, again, presents a significant opportunity for homegrown disruption, allowing local operators to innovate and adapt to meet the specific needs of their communities.

A lot is changing. The opportunity to go after this €200 billion market is wide open.

It’s time for legacy operators to fight fire with fire – to become the innovators leading the future of shared mobility. But to do this, they need to invest in the future – in cutting-edge technology, operational horsepower, and industry-leading talent. You can do all this while still holding on to your brand, your autonomy, and without having to hand over the steering wheel.

The industry is growing. Are you?

By Matthew Bezzina, eCabs Technologies’ CEO