How Auto Businesses Can Thrive in a Changing Industry

The Case for Diversification

The European car industry is under siege. Once the pride of the continent, it is now facing a two-pronged assault: declining demand and rising competition. Chinese automakers like BYD and MG are capitalising on economies of scale, cutting-edge technology, and aggressive pricing to dominate markets. In Norway, where EV adoption is at its highest, Chinese brands already account for 11% of the market, proving their ability to challenge Europe on its home turf. Meanwhile, even stalwarts like Stellantis are struggling; European production is faltering, and job cuts have become an unsettling norm. Tariffs may slow the bleeding, but as history with solar panels shows, protectionism cannot counter better products delivered at lower prices.

So what does this mean for dealerships, car rental companies, and other local auto businesses? It’s time to look beyond the showroom floor. The industry is shifting, and those who diversify now will be the ones who thrive tomorrow.

A Changing Market: Follow the Demographics

Car ownership is no longer the status symbol it once was. Millennials, Gen Zs, and Gen Alphas are increasingly turning away from the financial and environmental burdens of owning a car, a trend driven by urbanisation, rising costs, and climate awareness. Across Europe, driving licenses among young people have plummeted, with Britain seeing a 50% drop in teenagers obtaining licenses over the past two decades. Meanwhile, in cities like Paris, policies favoring pedestrians and public transport over cars are rapidly reshaping urban mobility.

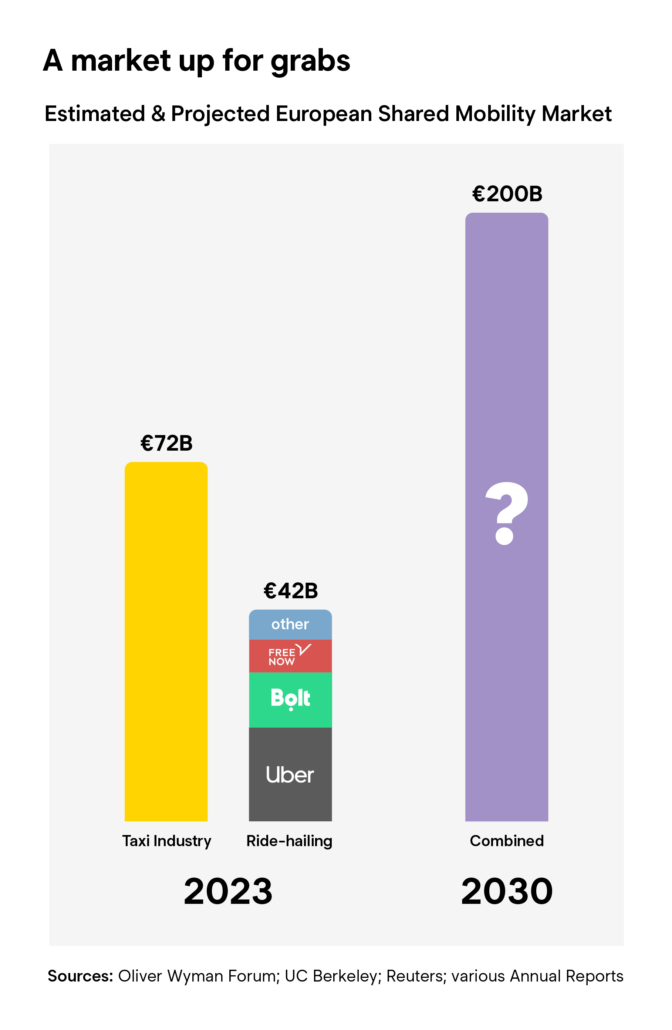

At the same time, the inefficiency of car ownership has come under scrutiny. On average, a car is in motion for only 5% of its life, spending the other 95% parked and underutilised. This inefficiency underscores the potential of shared mobility models, which allow for better utilisation of vehicles and public real estate while addressing consumer demand for flexibility. The rise of the shared mobility market—including car-sharing, subscriptions, and fleet rentals—is poised to reach €200 billion by 2030, marking a fundamental transformation in how vehicles are used and monetised.

Diversify to Drive Growth

For dealerships and rental companies, this transformation offers a lifeline. The infrastructure is already there—networks of cars, service technicians, customer relationships, and long-standing industry dominance and the social capital that comes with it—but the business model needs to evolve. Shared mobility offers an opportunity to tap into the growing demand for access over ownership. Mobility-as-a-service (MaaS) provides predictable, recurring revenue streams while meeting the needs of younger, digital-first, sustainability-conscious customers.

Crucially, this shift doesn’t require starting from scratch. Many local operators are well positioned to integrate shared mobility services into their existing operations. Expanding into short-term rentals or flexible fleet offerings allows businesses to do more with the resources they already have. For car dealerships, this might mean partnering with subscription providers or launching their own branded services. For rental companies, it could involve adopting new technologies to streamline operations and enhance user experiences.

The Time to Act Is Now

The European car industry is at a crossroads, but local businesses do not need to wait for manufacturers to pave the way. Shared mobility isn’t a threat—it’s an opportunity to get ahead of the curve, reach new customers, and ensure long-term resilience. The future belongs to those who recognise that mobility is changing and act decisively to adapt.

The next generation of customers is ready. Are you?

By Matthew Bezzina, eCabs Technologies’ CEO